Your How to find payg summary images are available in this site. How to find payg summary are a topic that is being searched for and liked by netizens now. You can Get the How to find payg summary files here. Get all free photos.

If you’re looking for how to find payg summary images information linked to the how to find payg summary topic, you have come to the right blog. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

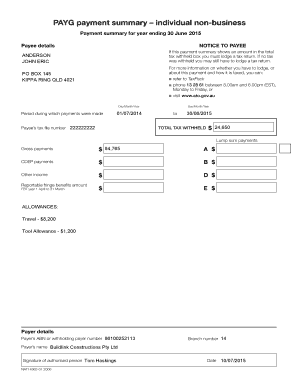

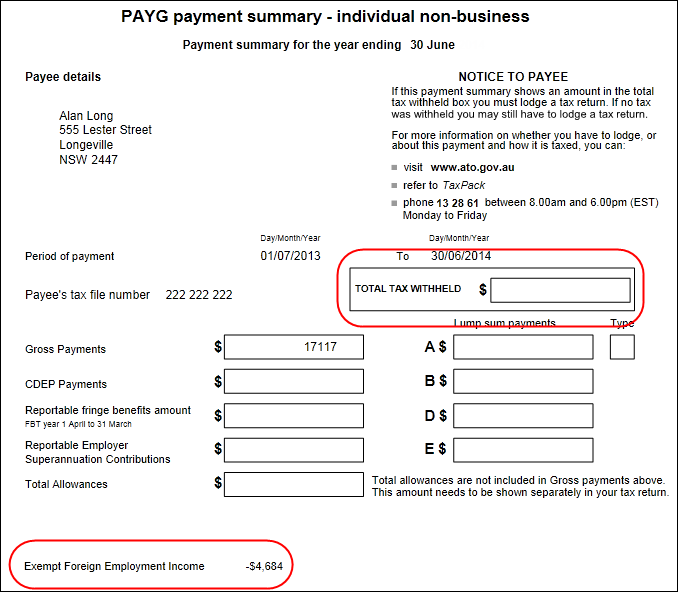

How To Find Payg Summary. Log in to myGov. If you received payments during the year and your employer deducted tax you should receive a PAYG payment summary formerly known as group certificate from them at the end of the year. Review payment summaries 3. Give a copy to the payee.

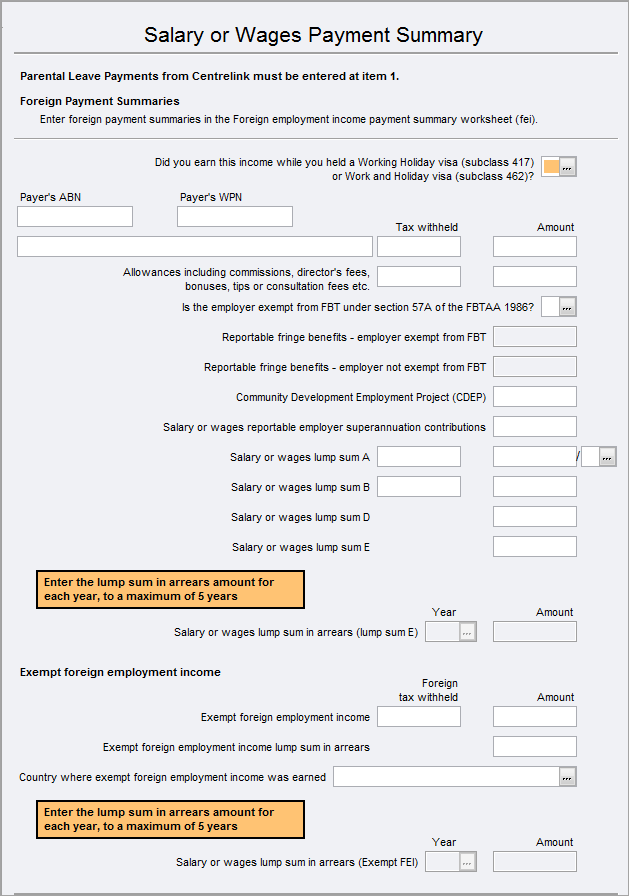

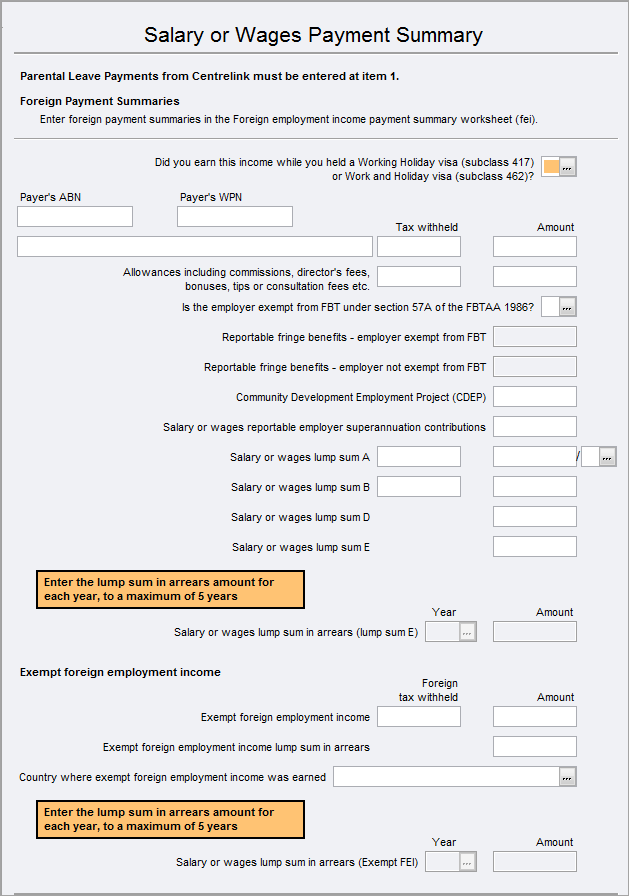

Salary Or Wages Payment Summary Egc Ps Help Tax Australia 2020 Myob Help Centre From help.myob.com

Salary Or Wages Payment Summary Egc Ps Help Tax Australia 2020 Myob Help Centre From help.myob.com

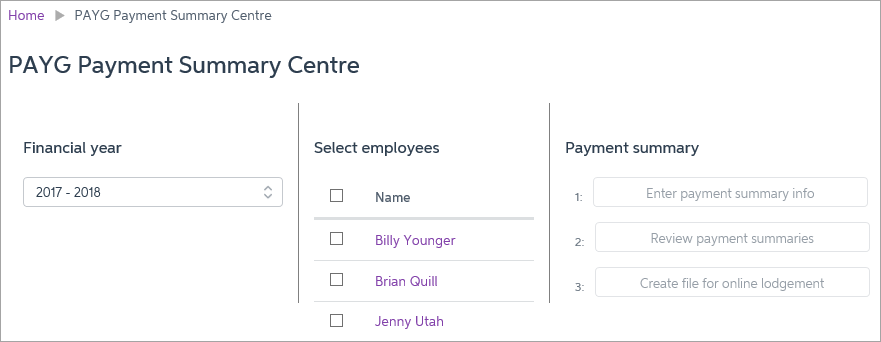

You can also select individuals by clicking on the check box next to their name. Those are all the same thing. Enter the new dollar amount or payment type or code. Select Australian Taxation Office. Under pay as you go PAYG withholding you must give each of your employees workers and other payees a payment summary showing the payments you have made to them and the amounts you withheld from those payments during a financial year. Of course as has been mentioned this is based on the assumption that all PAYG Payment Summaries have been submitted by your employers to the ATO.

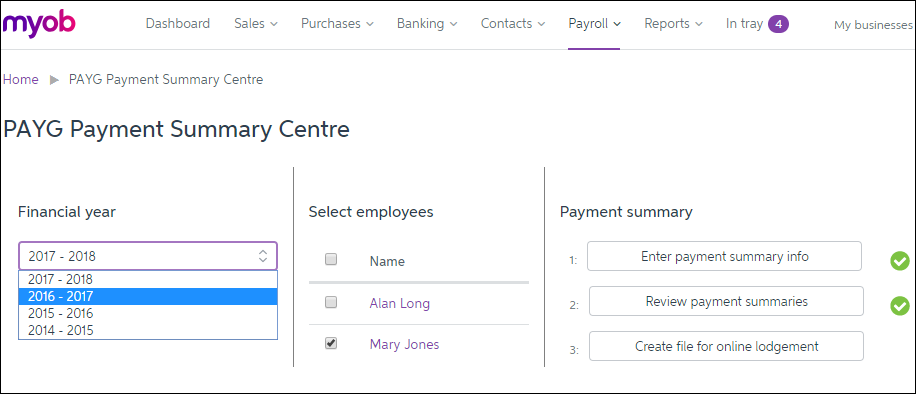

Go to Payroll Employees and click Payment Summaries.

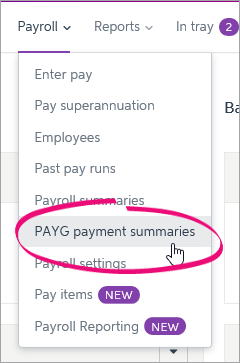

Your payment summary information will be available in ATO online services through myGov and it is called an Income Statement. Go to Payroll Employees and click Payment Summaries. Select Australian Taxation Office. Lodge the completed payment summary online or by post within 21 days of issuing the amended payment summary. To get there go to the Payroll menu and choose PAYG payment summaries. See below for details.

Source: help.myob.com

Source: help.myob.com

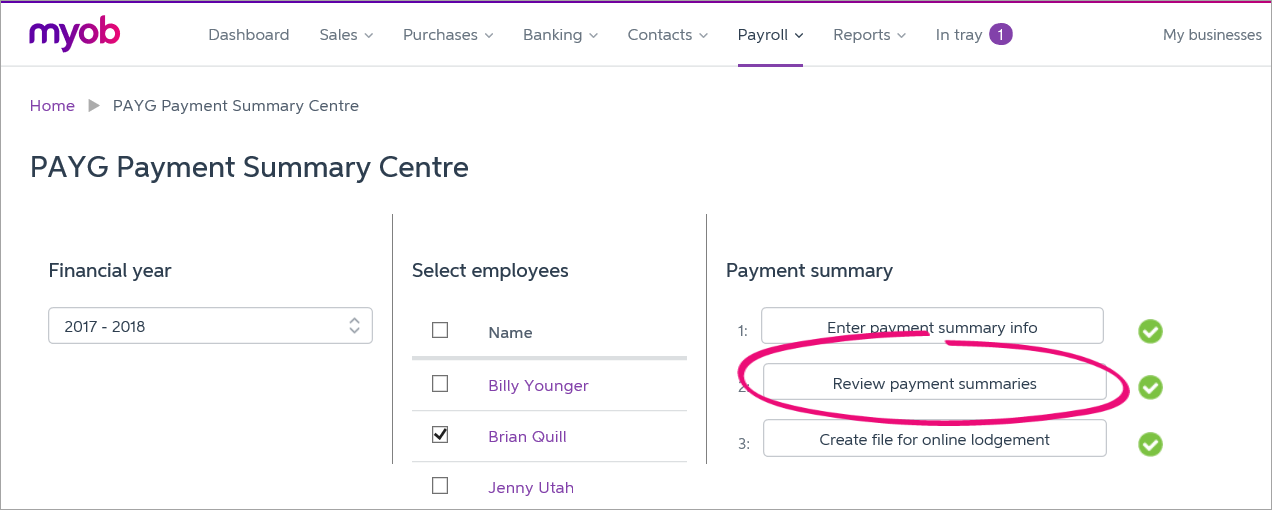

From 2020 the PAYG - Payment Summary is now known as the Income Statement. This information is matched to your tax file number and summarised in your pre-filling report. Click Review payment summaries. You can also select individuals by clicking on the check box next to their name. Choose the Financial year for the payment summaries you want to reprint.

Source: dynamics-hr-management.com

Source: dynamics-hr-management.com

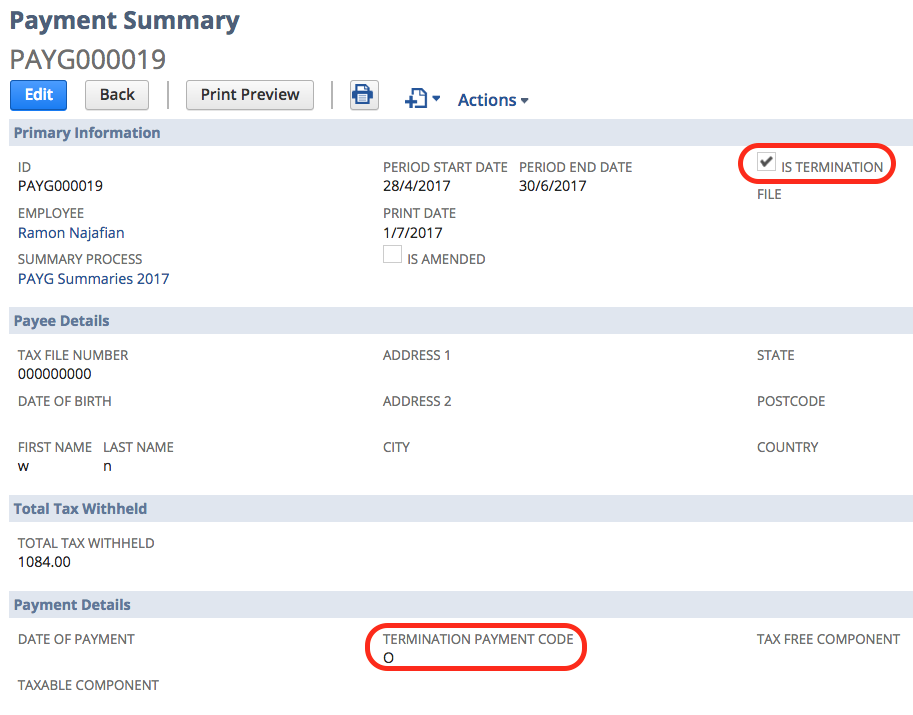

Give a copy to the payee. In earlier years you needed a PAYG to do your tax return and get a tax refund. PAYG withholding payment summaries corrections for incorrect type of form payee or payer details TFN dollar amount payment type or code and how to lodge your amendments. How you correct a mistake depends on what type of mistake it was. Give a copy to the payee.

Source: dynamics-hr-management.com

Source: dynamics-hr-management.com

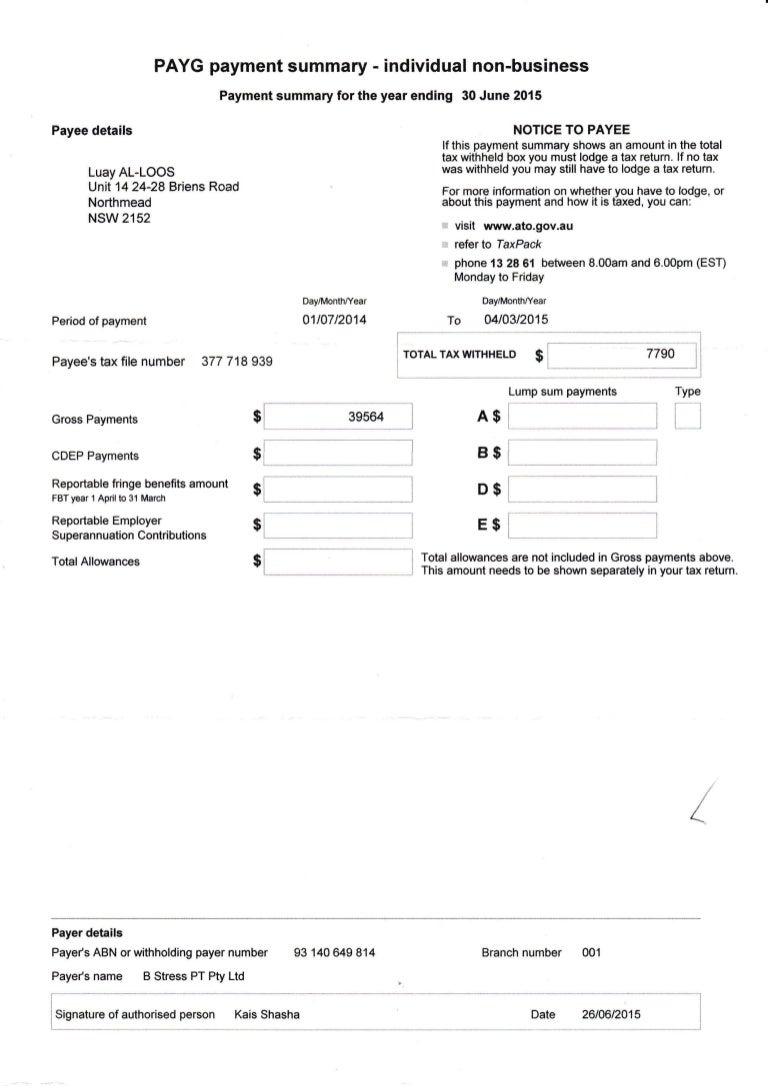

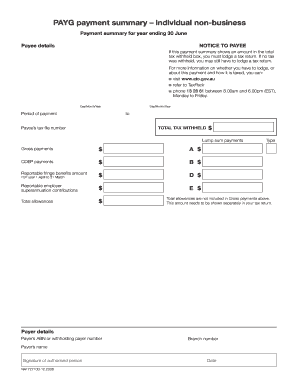

Download the form and print in A4 size PAYG payment summary individual non-business PDF 268KB NAT 0046 use our automated self-help publications ordering service at any time. Download the form and print in A4 size PAYG payment summary individual non-business PDF 268KB NAT 0046 use our automated self-help publications ordering service at any time. They are just words on a document with your annual income and tax paid by your employer to the ATO. It will show gross income tax withheld and the Australian Business Number of your employer. Review payment summaries 3.

Source: help.myob.com

Source: help.myob.com

Payment summaries can only be produced for the current payroll year that you are in. Download the form and print in A4 size PAYG payment summary individual non-business PDF 268KB NAT 0046 use our automated self-help publications ordering service at any time. Show the payee and payer information as it was on the original payment summary. Click Submit Payment Summaries directly to. How you correct a mistake depends on what type of mistake it was.

Source: dynamics-hr-management.com

Source: dynamics-hr-management.com

Of course as has been mentioned this is based on the assumption that all PAYG Payment Summaries have been submitted by your employers to the ATO. How you correct a mistake depends on what type of mistake it was. Under Payment summary there are 3 tasks to complete. As such if you have entered a pay on or after 01072021 you would be in the new payroll year and thus the Payment Summary Assistant would show you data for that new pay year. Log in to myGov.

Source: help.myob.com

Source: help.myob.com

Show the payee and payer information as it was on the original payment summary. Those are all the same thing. You can also select individuals by clicking on the check box next to their name. Select from the top of the screen Employment and then Income statements. The simplest and fastest way to find your missing tax information is to obtain your ATO Pre-filling Report.

Source: signnow.com

Source: signnow.com

Choose the Financial year for the payment summaries you want to reprint. To obtain a printed copy of the PAYG payment summary individual non-business form NAT 0046 you can either. The type of payment summary you give each of your payees will be determined by the type of payment you made as well as when it was paid. Show the payee and payer information as it was on the original payment summary. Enter the new dollar amount or payment type or code.

Source: help.myob.com

Source: help.myob.com

Select Australian Taxation Office. Log in to myGov. QSS submits STP reports containing payment information such as salaries and wages pay as you go PAYG withholding and superannuation to the ATO in-line with each payment cycle instead of annually at the end of each financial year. If you used Online Emailing or cannot find an email you will need to restore a backup copy of the file and re-prepare the Payment Summaries. You can also select individuals by clicking on the check box next to their name.

Source: platinumaccounting.com.au

Source: platinumaccounting.com.au

PAYG withholding payment summaries corrections for incorrect type of form payee or payer details TFN dollar amount payment type or code and how to lodge your amendments. If you have emailed the Payment Summaries to your employees you may be able to search your Sent Items in Outlook to find the PDF sent. Go to Payroll Employees and click Payment Summaries. Lodge the completed payment summary online or by post within 21 days of issuing the amended payment summary. This includes salary wages commissions and bonus payments.

Source: avers.com.au

Source: avers.com.au

Choose the Financial year for the payment summaries you want to reprint. Log in to myGov. Lets take you through them one by one. How to obtain this form To obtain a printed copy of the form. PAYG withholding payment summaries corrections for incorrect type of form payee or payer details TFN dollar amount payment type or code and how to lodge your amendments.

Source: jcurvesolutions1.zendesk.com

Source: jcurvesolutions1.zendesk.com

As such if you have entered a pay on or after 01072021 you would be in the new payroll year and thus the Payment Summary Assistant would show you data for that new pay year. The simplest and fastest way to find your missing tax information is to obtain your ATO Pre-filling Report. If you used Online Emailing or cannot find an email you will need to restore a backup copy of the file and re-prepare the Payment Summaries. QSS submits STP reports containing payment information such as salaries and wages pay as you go PAYG withholding and superannuation to the ATO in-line with each payment cycle instead of annually at the end of each financial year. As such if you have entered a pay on or after 01072021 you would be in the new payroll year and thus the Payment Summary Assistant would show you data for that new pay year.

Source: dynamics-hr-management.com

Source: dynamics-hr-management.com

Under Payment summary there are 3 tasks to complete. Given it to the payee provided your PAYG payment summary annual report to us. Select all employees by clicking on the check box in the column heading. Select Australian Taxation Office. Under pay as you go PAYG withholding you must give each of your employees workers and other payees a payment summary showing the payments you have made to them and the amounts you withheld from those payments during a financial year.

Source: semmensco.com.au

Source: semmensco.com.au

How you correct a mistake depends on what type of mistake it was. Payment summaries for workers Payment summaries where no ABN was quoted Electronic payment summaries Part-year payment summaries Paper payment summaries Payment summaries for workers. You will receive an income statement from the ATO. If you have emailed the Payment Summaries to your employees you may be able to search your Sent Items in Outlook to find the PDF sent. User 693580 835 posts Snowman123.

Source: slideshare.net

Source: slideshare.net

Choose the Financial year for the payment summaries you want to reprint. Of course as has been mentioned this is based on the assumption that all PAYG Payment Summaries have been submitted by your employers to the ATO. From 2020 the PAYG - Payment Summary is now known as the Income Statement. You can also select individuals by clicking on the check box next to their name. Lets take you through them one by one.

Source: astonaccountants.com.au

Source: astonaccountants.com.au

If you have emailed the Payment Summaries to your employees you may be able to search your Sent Items in Outlook to find the PDF sent. The type of payment summary you give each of your payees will be determined by the type of payment you made as well as when it was paid. User 693580 835 posts Snowman123. Select Australian Taxation Office. Of course as has been mentioned this is based on the assumption that all PAYG Payment Summaries have been submitted by your employers to the ATO.

Source: signnow.com

Source: signnow.com

Lodge the completed payment summary online or by post within 21 days of issuing the amended payment summary. The type of payment summary you give each of your payees will be determined by the type of payment you made as well as when it was paid. This information is matched to your tax file number and summarised in your pre-filling report. Review payment summaries 3. Start by choosing the financial year and selecting the employees youre preparing payment summaries for.

Source: avers.com.au

Source: avers.com.au

Payment summaries can only be produced for the current payroll year that you are in. Select from the top of the screen Employment and then Income statements. This includes salary wages commissions and bonus payments. From 2020 the PAYG - Payment Summary is now known as the Income Statement. Lets make this really simple.

Source: help.myob.com

Source: help.myob.com

See below for details. Access your income statement You will receive either an income statement in ATO online services via myGov or a payment summary from your employer depending on how your employer reports. If they report your income tax and super information through Single Touch Payroll your income statement will be in ATO online services. Click Review payment summaries. Using your income statement for your tax return You can view your income statement at any time throughout the financial year.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to find payg summary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.