Your Other assets summary centrelink images are available in this site. Other assets summary centrelink are a topic that is being searched for and liked by netizens today. You can Download the Other assets summary centrelink files here. Find and Download all free images.

If you’re searching for other assets summary centrelink images information connected with to the other assets summary centrelink keyword, you have come to the right blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Other Assets Summary Centrelink. 144 Accounting for the Impairment or Disposal of Long-Lived Assets. This is because Centrelink will need to determine the amount of income attributed to you based on the details of your trust or private company. View home contents personal effects vehicles and other assets details. Then select Continue to proceed.

Eas Frequently Asked Questions Qtac From qtac.edu.au

Eas Frequently Asked Questions Qtac From qtac.edu.au

The deposit money is no longer accessible to the pensioner as available money or as an accessible. As a result if your bank balance increases over time it may impact your pension. 144 Accounting for the Impairment or Disposal of Long-Lived Assets. If youre part of a couple the limit is for yourself and your partners assets. The guidance for cryptocurrency is not very clear to say the least so its taken me a while try and understand what my obligations are. You cant update some income and assets online.

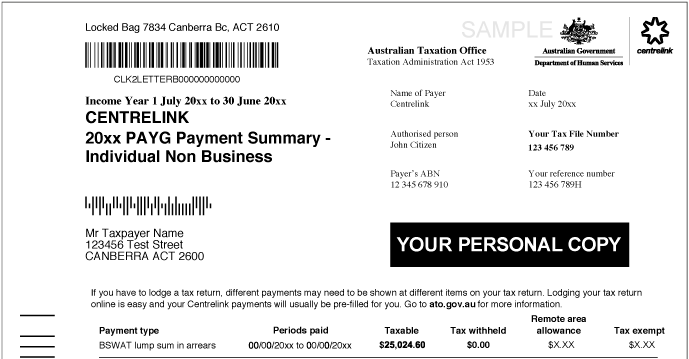

To view the document select the Income Statement link.

You cant update some income and assets online. As for your superannuation balance your provider may update Centrelink on your behalf. Centrelink has strict rules in place to ensure that people do not dispose of their assets by gifting them to family members or others in an effort to influence their eligibility for the age pension or aged care costs. On the Income and assets summary page select ViewEdit details in Other income. You can request a. Credit cards unsecured loans third party loans etc.

Source: servicesaustralia.gov.au

Source: servicesaustralia.gov.au

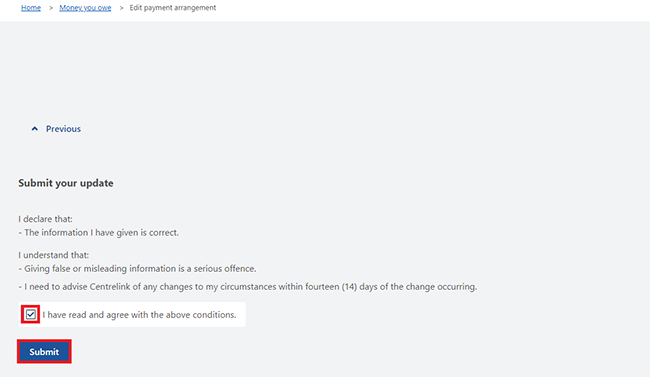

Circumstances such as change in income assets martitual status death or living arrangements must be reported to Centrelink within 14 days. These provisions are explained in the. You cant update some income and assets online. Age of consent rules. Granny flat interest The granny flat interest is an exception to social security law to ensure that when an older person transfers title of their property proceeds of their property or other assets to a family member or similar in return for care and accommodation that is.

The test also considers where the land is how its being used for example for commercial purposes an applicants health family situation and other factors. Centrelink include your bank balance when determining your level of assets. If you dont let Centrelink know about these changes theres a chance you could be overpaid. Centrelink and SMSFs the assets test and the income will be counted as an asset under the assets test and possibly counted by the deeming rules under the EXECUTIVE SUMMARY TO ESTABLISH A SINGLE MODEL BUSINESSES CAN follow FASB issued Statement no. Select Income and assets then Income and assets details and Manage income and assets.

Source: ato.gov.au

Source: ato.gov.au

Granny flat interest The granny flat interest is an exception to social security law to ensure that when an older person transfers title of their property proceeds of their property or other assets to a family member or similar in return for care and accommodation that is. I recently realised I hadnt update my assets on my centrelink account for a long time. I have tried contacting Centrelink a few times and havent been able to get through to anyone. For those with an iPhone or iPad Centrelink has an app called Centrelink Express Plus that can be used to update details. If youre part of a couple the limit is for yourself and your partners assets.

Read What you need to know before you start. Select MENU from your homepage. Other assets Select Yes to this question if you have any other assets you have not already advised us about. You can request a. For property indicate the amount of mortgage andor any other loan against the property.

Select MENU from your homepage. For other assets indicate the amount of loans. Actual income of financial investments is ignored and instead deeming rules apply. You cant update some income and assets online. As a result if your bank balance increases over time it may impact your pension.

For more information please contact Centrelink. Credit cards unsecured loans third party loans etc. The threshold for individual and jointly held funeral bonds is 13500. Centrelink fact sheet. If youre part of a couple the limit is for yourself and your partners assets.

If you dont let Centrelink know about these changes theres a chance you could be overpaid. As you have said Centrelink will assess and pay each of you as a couple regardless of your individual incomeassets. You cant update some income and assets online. Any earnings on exempt bond are also exempt. When Centrelink assesses your income and assets they may attribute a different amount than the amount you include here.

Read What you need to know before you start. Select Continue to proceed. Many do this twice a year. A persons eligibility for the age pension is continually reassessed. When Centrelink assesses your income and assets they may attribute a different amount than the amount you include here.

Source: servicesaustralia.gov.au

Source: servicesaustralia.gov.au

Depending on the level of support your wife requires if she were to move into an aged care facility then the two of you may become eligible to be assessed as a couple separated due to ill health which has a higher pension amount. Close Window Top of Page Print Page Partner For Centrelink purposes a partner is a person of above the age of consent that you are married to or are living as a member of a couple. After all the details have been collected you will be returned to the Other Asset Summary page with all the new details. Many do this twice a year. Ive added the current value of what I own to other.

Source: servicesaustralia.gov.au

Source: servicesaustralia.gov.au

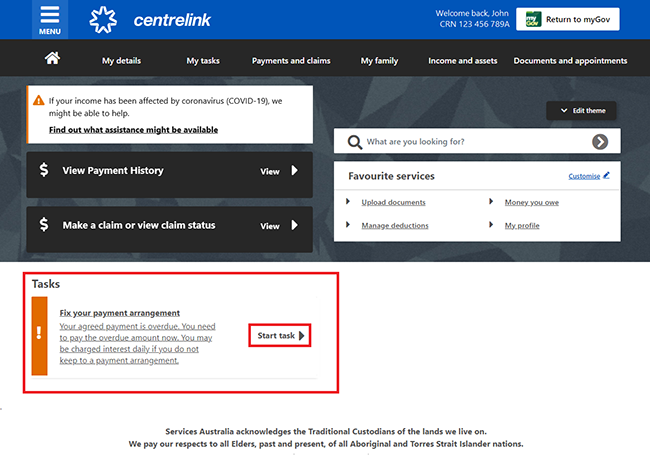

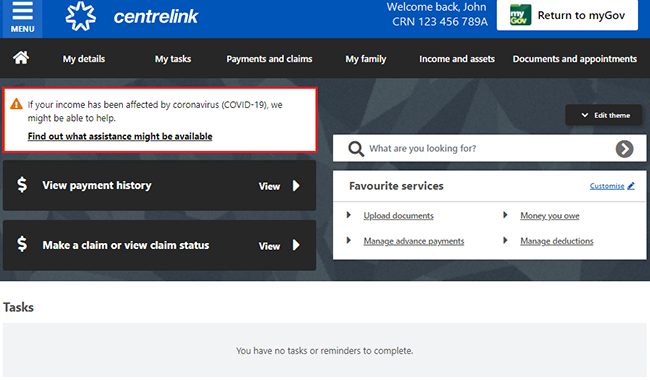

You will be taken to a new page that will ask a series of questions to collect all details for the asset. Sign in to myGov and select Centrelink. The test also considers where the land is how its being used for example for commercial purposes an applicants health family situation and other factors. If you dont let Centrelink know about these changes theres a chance you could be overpaid. Select Income and assets then Income and assets details and Manage income and assets.

Sign in to myGov and select Centrelink. Your income and assets categories will display on the Income and assets summary page. Any earnings on exempt bond are also exempt. Select ViewEdit details in the income and assets category you want to view or update. Since I last updated it Ive made some small investments that have become a pretty decent amount of money 40k.

Source: progressivefs.com.au

Source: progressivefs.com.au

I have tried contacting Centrelink a few times and havent been able to get through to anyone. Couples could have 27000 exempt if they hold separate funeral bonds but only. Other assets Select Yes to this question if you have any other assets you have not already advised us about. If you are youll need to pay the money back including interest so its a financial burden best avoided by making sure you keep Centrelink in. The guidance for cryptocurrency is not very clear to say the least so its taken me a while try and understand what my obligations are.

Source: qtac.edu.au

Source: qtac.edu.au

Since I last updated it Ive made some small investments that have become a pretty decent amount of money 40k. You cant update some income and assets online. No updates allowed at this time to your Income and Assets due to changes in progress message. Sign in to myGov and select Centrelink. Select MENU from your homepage.

For those with an iPhone or iPad Centrelink has an app called Centrelink Express Plus that can be used to update details. As you have said Centrelink will assess and pay each of you as a couple regardless of your individual incomeassets. For more information please contact Centrelink. Today however I get a Locked account. Each month I report my income to Centrelink in the Income and Assets Summary page.

Select Income and assets then Income and assets details and Manage income and assets. Couples could have 27000 exempt if they hold separate funeral bonds but only. How to Add an Other Asset. The LAWP liquid assets waiting period applies to ALL YA Youth Allowance Austudy JSP JobSeeker Payment and SA Sickness Allowance recipients whose liquid assets exceed a specified amount. Credit cards unsecured loans third party loans etc.

To view the document select the Income Statement link. Since I last updated it Ive made some small investments that have become a pretty decent amount of money 40k. How do I download a Centrelink payment summary. Select Continue to proceed. Each month I report my income to Centrelink in the Income and Assets Summary page.

Source: yumpu.com

Source: yumpu.com

No updates allowed at this time to your Income and Assets due to changes in progress message. Youll need to contact us to change any of the following. The deposit money is no longer accessible to the pensioner as available money or as an accessible. Select ViewEdit details in the income and assets category you want to view or update. To view the document select the Income Statement link.

Source: studylib.net

Source: studylib.net

Circumstances such as change in income assets martitual status death or living arrangements must be reported to Centrelink within 14 days. For property indicate the amount of mortgage andor any other loan against the property. A persons eligibility for the age pension is continually reassessed. How to update your income and assets details using your Centrelink online account. Age of consent rules.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title other assets summary centrelink by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.