Your Van gend en loos summary images are available. Van gend en loos summary are a topic that is being searched for and liked by netizens now. You can Download the Van gend en loos summary files here. Get all royalty-free images.

If you’re looking for van gend en loos summary images information connected with to the van gend en loos summary topic, you have pay a visit to the right site. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

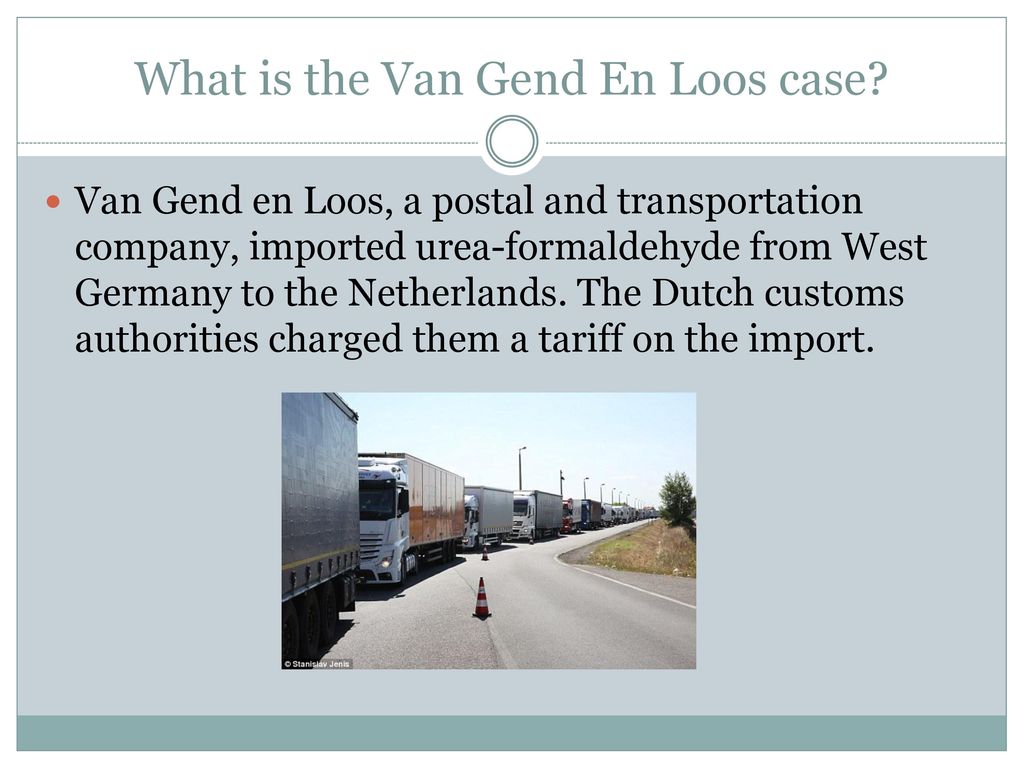

Van Gend En Loos Summary. Established the principle of and test for direct effect. Van Gend en Loos 1963 Case 2662 Case summary last updated at 05022020 1137 by the Oxbridge Notes in-house law team. The Van Gend Loos judgment is one of the most important judgments in the development of the Community legal order. Van Gend en Loos a postal and transportation company imported urea formaldehyde from West Germany to the Netherlands.

Pdf Access To Justice And The Development Of The Van Gend En Loos Doctrine The Role Of Courts And Of The Individual In Eu Law From researchgate.net

Pdf Access To Justice And The Development Of The Van Gend En Loos Doctrine The Role Of Courts And Of The Individual In Eu Law From researchgate.net

The judgement in Van Gend en Loos has undoubtedly had a huge impact upon the European Union and the way that it functions. V Ministry for Finance of the Italian R epublic Case 43-71. Franz Grad v Finanzamt Traunstein case 970 1970 ECR 825 5. Die niederländische Transportfirma van Gend Loos führte 1960 aus Deutschland Chemikalien in die Niederlande ein. The Dutch customs authorities were in violation of what is now Art 30 TFEU. 04 November 2020 William Phelan Chapter Get access Summary This chapter discusses the Courts 1963 judgment Van Gend en Loos where the Court declared that European law could be relied upon by private individuals before their national courts.

Van Gend En Loos imported a type of plastic from Germany into the Netherlands.

Transportunternehmen Van Gend Loos beim Europäischen Gerichtshof EuGH gegen überhöhte niederl. 2 - Van Gend en Loos 1963 Direct Effect Published online by Cambridge University Press. Allows actions in UK Courts on basis of EU law Can be used as a shield or sword s2 1 ECA 1972 - UK courts are to give effect to EU law Van Gend En Loos v Nederlandse Authority. The judgement in Van Gend en Loos has undoubtedly had a huge impact upon the European Union and the way that it functions. Costa v ENEL case 664 1964 ECR 585 - ECJ 3. NV Algemene Transport- en Expeditie Onderneming van Gend Loos v Netherlands Inland Revenue Administration.

Source: simplestudying.com

Source: simplestudying.com

Upon arrival Dutch customs authorities demanded a type of import tax to be paid. The Dutch customs authorities were in violation of what is now Art 30 TFEU. Costa v ENEL case 664 1964 ECR 585 - ECJ 3. 25 EGV war die nachträgliche Erhöhung von Einfuhrzöllen die bereits existierten als der Vertrag in Kraft trat verboten. Facts The claimants van Gend en Loos imported chemicals from Western Germany to the Netherlands where they were asked to pay import taxes at Dutch customs the defendants which they objected to on the grounds it ran contrary to the European Economic Communitys prohibition on inter-State import duties as per Article 12 of the Treaty of Rome.

Source: prezi.com

Source: prezi.com

Costa v ENEL case 664 1964 ECR 585 - ECJ 3. 2 - Van Gend en Loos 1963 Direct Effect Published online by Cambridge University Press. Das van Gend Loos Urteil ist eine der wichtigsten EuGH Entscheidungen. Reference for a preliminary ruling. The claimants van Gend en Loos imported chemicals from Western Germany to the Netherlands where they were asked to pay import taxes at Dutch customs the defendants which they objected to on the grounds it ran contrary to the European Economic Communitys prohibition on inter-State import duties as per Article 12 of the Treaty of Rome.

Source: slideplayer.com

Source: slideplayer.com

Could Van Gend En Loos rely on EU law in order to refuse to pay the import tax. Zum einen hat der EuGH in dieser Entscheidung klar gestellt dass es sich bei dem Gemeinschaftsrecht um eine von den Mitgliedsstaaten losgelöste eigenständige Rechtsordnung handelt. Zum anderen hat der EuGH hier in diesem Urteil entschieden dass nicht nur die Mitgliedstaaten sondern. Van gend loos stands for the proposition that the european union or european economic community as it was known then is a new legal order different from ordinary institutional organisations in that the laws of the european union are part of the law of the land of each of the member states for national judges to enforce van gend. The European Court of Justice specifies that the Community constitutes a new legal order of international law for the benefit of which the States have limited their sovereign rights and the subjects of which comprise not only Member States but also their nationals.

Source: youtube.com

Source: youtube.com

V Ministry for Finance of the Italian R epublic Case 43-71. Van Gend En Loos imported a type of plastic from Germany into the Netherlands. Van Gend en Loos v Nederlandse Tariefcommissie cas e 2662 1963 ECR 1. NV Algemene Transport- en Expeditie Onderneming van Gend Loos v Netherlands Inland Revenue Administration. Member States shall refrain.

Van Gend en Loos 1963 Case 2662 Case summary last updated at 05022020 1137 by the Oxbridge Notes in-house law team. Allows actions in UK Courts on basis of EU law Can be used as a shield or sword s2 1 ECA 1972 - UK courts are to give effect to EU law Van Gend En Loos v Nederlandse Authority. Costa v ENEL case 664 1964 ECR 585 - Italian C onstitutional Court 4. Could Van Gend En Loos rely on EU law in order to refuse to pay the import tax. In Van Gend en Loos the claimant had been charged an import duty by the Dutch authorities.

The transport company Van Gend en Loos imported a certain quantity of urea-methanal which belonged to a specific category in the tariff of. Costa v ENEL case 664 1964 ECR 585 - Italian C onstitutional Court 4. The authorities charged them a tariff on the import. Van Gend en Loos objected stating that it was a clear violation of Article 12 of the Treaty of Rome now replaced by Article 30 TFEU which stated. Transportunternehmen Van Gend Loos beim Europäischen Gerichtshof EuGH gegen überhöhte niederl.

Source: brill.com

Source: brill.com

Transportunternehmen Van Gend Loos beim Europäischen Gerichtshof EuGH gegen überhöhte niederl. Could Van Gend En Loos rely on EU law in order to refuse to pay the import tax. Importzölle die nach Ansicht des Klägers gegen den damaligen EWG-Vertrag verstießen. Van Gend en Loos a postal and transportation company imported chemicals from Germany into the Netherlands and was charged an import duty that had been raised since the entry into effect of the Treaty of Rome. Van Gend en Loos v Nederlandse Tariefcommissie cas e 2662 1963 ECR 1.

Source: curia.europa.eu

Source: curia.europa.eu

Van Gend en Loos 1963 Case 2662 Case summary last updated at 05022020 1137 by the Oxbridge Notes in-house law team. Van Gend en Loos objected stating that it was a clear violation of Article 12 of the Treaty of Rome now replaced by Article 30 TFEU which stated. Im selben Jahr wurde in den Niederlanden der Einfuhrzolltarif für eben dieses chemische Produkt neu festgelegt sodass die niederländische Finanzverwaltung auf die Einfuhr einen nunmehr höheren Zoll erhob. Zum anderen hat der EuGH hier in diesem Urteil entschieden dass nicht nur die Mitgliedstaaten sondern. Costa v ENEL case 664 1964 ECR 585 - Italian C onstitutional Court 4.

Source: researchgate.net

Source: researchgate.net

Franz Grad v Finanzamt Traunstein case 970 1970 ECR 825 5. Van Gend en Loos v Nederlandse Tariefcommissie cas e 2662 1963 ECR 1. NV Algemene Transport- en Expeditie Onderneming van Gend Loos v Netherlands Inland Revenue Administration. The claimants van Gend en Loos imported chemicals from Western Germany to the Netherlands where they were asked to pay import taxes at Dutch customs the defendants which they objected to on the grounds it ran contrary to the European Economic Communitys prohibition on inter-State import duties as per Article 12 of the Treaty of Rome. Franz Grad v Finanzamt Traunstein case 970 1970 ECR 825 5.

Source: lawteacher.net

Source: lawteacher.net

Costa v ENEL case 664 1964 ECR 585 - Italian C onstitutional Court 4. Could Van Gend En Loos rely on EU law in order to refuse to pay the import tax. Member States shall refrain. The Dutch customs authorities were in violation of what is now Art 30 TFEU. Judgment of the Court of 5 February 1963.

Source: drwernaart.com

Source: drwernaart.com

Van Gend en Loos v Nederlandse Tariefcommissie cas e 2662 1963 ECR 1. Das van Gend Loos Urteil ist eine der wichtigsten EuGH Entscheidungen. Van Gend en Loos v Nederlandse Tariefcommissie cas e 2662 1963 ECR 1. The Dutch customs authorities were in violation of what is now Art 30 TFEU. The phrase new legal order was first used in Van Gend en.

Source: researchgate.net

Source: researchgate.net

The Van Gend Loos judgment is one of the most important judgments in the development of the Community legal order. Judgment of the Court of 5 February 1963. Van Gend paid the tariff but then sought reimbursement in court before the Dutch Tariefcommissie alleging violation of Article 12 of the Treaty of Rome. In Van Gend en Loos the claimant had been charged an import duty by the Dutch authorities. NV Algemene Transport- en Expeditie Onderneming van Gend Loos v Netherlands Inland Revenue Administration.

Source: commons.wikimedia.org

Source: commons.wikimedia.org

The authorities charged them a tariff on the import. Upon arrival Dutch customs authorities demanded a type of import tax to be paid. Franz Grad v Finanzamt Traunstein case 970 1970 ECR 825 5. 25 EGV war die nachträgliche Erhöhung von Einfuhrzöllen die bereits existierten als der Vertrag in Kraft trat verboten. 2 - Van Gend en Loos 1963 Direct Effect Published online by Cambridge University Press.

Van Gend En Loos imported a type of plastic from Germany into the Netherlands. The judgement in Van Gend en Loos has undoubtedly had a huge impact upon the European Union and the way that it functions. Judgement for the case Van Gend en Loos A Dutch company importing chemicals from Germany were forced to pay a higher tariff than article 12 of the EEC Treaty allowed. Van gend loos stands for the proposition that the european union or european economic community as it was known then is a new legal order different from ordinary institutional organisations in that the laws of the european union are part of the law of the land of each of the member states for national judges to enforce van gend. The Van Gend Loos judgment is one of the most important judgments in the development of the Community legal order.

Source: commons.wikimedia.org

Source: commons.wikimedia.org

The phrase new legal order was first used in Van Gend en. En ExpeditieOnderneming VAN GEND Loos having its registered office at Utrecht represented by HG. Upon arrival Dutch customs authorities demanded a type of import tax to be paid. The Van Gend Loos judgment is one of the most important judgments in the development of the Community legal order. 04 November 2020 William Phelan Chapter Get access Summary This chapter discusses the Courts 1963 judgment Van Gend en Loos where the Court declared that European law could be relied upon by private individuals before their national courts.

Zum einen hat der EuGH in dieser Entscheidung klar gestellt dass es sich bei dem Gemeinschaftsrecht um eine von den Mitgliedsstaaten losgelöste eigenständige Rechtsordnung handelt. The Van Gend Loos judgment is one of the most important judgments in the development of the Community legal order. Reference for a preliminary ruling. The claimants van Gend en Loos imported chemicals from Western Germany to the Netherlands where they were asked to pay import taxes at Dutch customs the defendants which they objected to on the grounds it ran contrary to the European Economic Communitys prohibition on inter-State import duties as per Article 12 of the Treaty of Rome. NV Algemene Transport- en Expeditie Onderneming van Gend Loos v Netherlands Inland Revenue Administration.

Source: grin.com

Source: grin.com

Reference for a preliminary ruling. Van Gend paid the tariff but then sought reimbursement in court before the Dutch Tariefcommissie alleging violation of Article 12 of the Treaty of Rome. The phrase new legal order was first used in Van Gend en. Van Gend en Loos a postal and transportation company imported urea formaldehyde from West Germany to the Netherlands. 04 November 2020 William Phelan Chapter Get access Summary This chapter discusses the Courts 1963 judgment Van Gend en Loos where the Court declared that European law could be relied upon by private individuals before their national courts.

Source: en.ppt-online.org

Source: en.ppt-online.org

The Van Gend Loos judgment is one of the most important judgments in the development of the Community legal order. Van gend loos stands for the proposition that the european union or european economic community as it was known then is a new legal order different from ordinary institutional organisations in that the laws of the european union are part of the law of the land of each of the member states for national judges to enforce van gend. Van Gend En Loos imported a type of plastic from Germany into the Netherlands. Franz Grad v Finanzamt Traunstein case 970 1970 ECR 825 5. Case 2662 Van Gend en Loos v Nederlandse Administratie der Belastingen 1963 ECR 1 is a European Union Law case concerning the Doctrine of Direct Effect.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title van gend en loos summary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.