Your Work related travel expenses 2021 images are ready. Work related travel expenses 2021 are a topic that is being searched for and liked by netizens today. You can Download the Work related travel expenses 2021 files here. Find and Download all royalty-free vectors.

If you’re looking for work related travel expenses 2021 pictures information linked to the work related travel expenses 2021 interest, you have visit the right blog. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Work Related Travel Expenses 2021. You cannot deduct commuting expenses for transportation between your home and your regular place of work. Plausible reasons include meeting with local clients or attending a local conference and then extending your stay. Public transport air travel and taxi fares. Complete this section if you incurred travel expenses you incur in performing your work as an employee.

Pin By Roller And Metalizer Co On Nepal In 2021 Excel Budget Spreadsheet Template Inventory Management Templates From pinterest.com

Pin By Roller And Metalizer Co On Nepal In 2021 Excel Budget Spreadsheet Template Inventory Management Templates From pinterest.com

We do have a limited travel budget so if your employer or other source is able to cover the cost of your. Mileage expenses or car rental. The work-related costs scheme werkkostenregeling WKR enables you to spend part of your total taxable wage the discretionary scope on allowances benefits in kind and provisions for your employees without tax liabilityHow does the WKR scheme work. So really anything you spend for work can be claimed back up to 300 without having to show any receipts. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Public transport air travel and taxi fares.

Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less.

The rate is 25100 for married filing jointly. Also you may not deduct travel expenses at a work location if you realistically expect that youll work. This includes costs for. Parking fees tolls and travel by bus and train also qualify as business travel expenses. If you ever have to travel for work your employer has to cover all necessary travel expenses too. Meal accommodation and incidental expenses you incur while away overnight for work.

Source: pinterest.com

Source: pinterest.com

If you make use of the work-related costs scheme you do not have to pay wage tax on the amount within the so. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. Meal accommodation and incidental expenses you incur while away overnight for work. 2021 Travel and Business-Related Expense Policy.

Source: pinterest.com

Source: pinterest.com

Plausible reasons include meeting with local clients or attending a local conference and then extending your stay. Parking and tolls. MyTax 2021 Work-related travel expenses. For tax year 2021 the flat rate is 12550 for single filers and those married filing separately. Common travel expenses include among others.

Source: blog.spendesk.com

Source: blog.spendesk.com

Government agencies in Nevada are required to reimburse their employees for eligible work-related travel expenses. However you cant deduct travel expenses paid in connection with an indefinite work assignment. Additionally the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2021. If you carry tools instruments or other items in your car to and from work you can deduct only the additional. You cannot deduct commuting expenses for transportation between your home and your regular place of work.

Source: blog.spendesk.com

Source: blog.spendesk.com

56 cents per mile driven for business use down 15 cents from the rate for 2020. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. Small Biz Genius 2021 Businesses spend roughly 1425 for every employee they send on a business trip. Common travel expenses include among others. If you carry tools instruments or other items in your car to and from work you can deduct only the additional.

Source: pinterest.com

Source: pinterest.com

Travel tofrom work is defined as travel between your home and your permanent places of work and thus constitutes private travel. You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. If an employer pays an allowance for travel tofrom work this will be considered fully taxable income. This means that come tax season you can claim your expenses for gas car maintenance and more against your taxes. 2021 Travel and Business-Related Expense Policy.

Source: travelperk.com

Source: travelperk.com

However we consider you to be the owner or lessee of a car and eligible to claim expenses where a family or private arrangement made you the owner or lessee even though you were not. If you make use of the work-related costs scheme you do not have to pay wage tax on the amount within the so. For landlords mileage as well as other car-related and travel expenses are deductible in the year incurred. Meals qualify if they were related to a business trip or needed for a business purpose such as a client. You cannot deduct commuting expenses for transportation between your home and your regular place of work.

Source: free-power-point-templates.com

Source: free-power-point-templates.com

Government agencies in Nevada are required to reimburse their employees for eligible work-related travel expenses. 2021 Work Related Travel Expensesdoc Special substantiation rules apply to expenses in relation to overseas and domestic travel. However if youre a freelance software developer working from Thailand because you like the weather that unfortunately doesnt count as. However you cant deduct travel expenses paid in connection with an indefinite work assignment. This includes costs for.

Source: pinterest.com

Source: pinterest.com

The average daily cost of business travel in the US is 325 per day. In this article our Las Vegas Nevada labor law attorneys discuss. You can deduct 11 18 of the round-trip plane fare and other travel expenses from New York to Paris plus your non-entertainment-related meals subject to the 50 limit lodging and any other business expenses you had in Paris. You can also deduct the cost of laundry meals baggage telephone expenses and tips while you are on business in a temporary setting. The rate is 25100 for married filing jointly.

Source: pinterest.com

Source: pinterest.com

If you carry tools instruments or other items in your car to and from work you can deduct only the additional. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. If you ever have to travel for work your employer has to cover all necessary travel expenses too. In this article our Las Vegas Nevada labor law attorneys discuss. But your employer isnt.

Source: travelperk.com

Source: travelperk.com

MyTax 2021 Work-related travel expenses. Also you may not deduct travel expenses at a work location if you realistically expect that youll work. Business travel is considered to be job-related travel and can be paid free of payroll withholding tax up to the rates specified in the tax rules. But your employer isnt. If you ever have to travel for work your employer has to cover all necessary travel expenses too.

Source: pinterest.com

Source: pinterest.com

The work-related costs scheme werkkostenregeling WKR enables you to spend part of your total taxable wage the discretionary scope on allowances benefits in kind and provisions for your employees without tax liabilityHow does the WKR scheme work. Note that the standard mileage reimbursement rate is 545 a mile. This includes costs for. Work-related expenses refer to car expenses travel clothing phone calls union fees training conferences and books. However we consider you to be the owner or lessee of a car and eligible to claim expenses where a family or private arrangement made you the owner or lessee even though you were not.

Source: travelperk.com

Source: travelperk.com

In this article our Las Vegas Nevada labor law attorneys discuss. Complete this section if you incurred travel expenses you incur in performing your work as an employee. You claim deductions for them at items D1 and D2. MyTax 2021 Work-related travel expenses. Public Transport Fares.

Source: travelperk.com

Source: travelperk.com

You cannot deduct commuting expenses for transportation between your home and your regular place of work. In this article our Las Vegas Nevada labor law attorneys discuss. Parking fees tolls and travel by bus and train also qualify as business travel expenses. 2021 Travel and Business-Related Expense Policy. Travel expenses and mileage reimbursements.

Source: pinterest.com

Source: pinterest.com

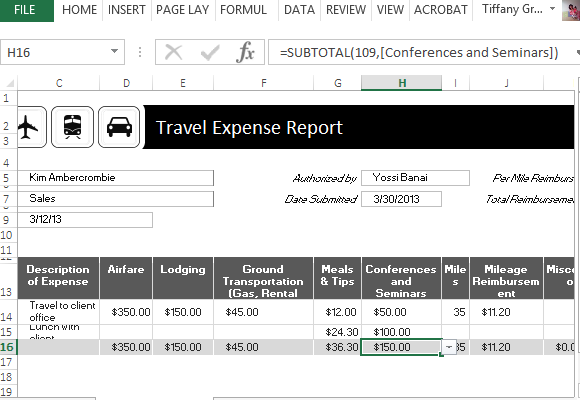

Travel expenses and mileage reimbursements. Car and travel expenses 2021 Work-related car expenses and work-related travel expenses are expenses you incur in the course of performing your job as an employee. 2021 Travel and Business-Related Expense Policy. As long as you have some work-related reason for traveling these excursion count as business trips. The rate is 25100 for married filing jointly.

Source: pinterest.com

Source: pinterest.com

Government agencies in Nevada are required to reimburse their employees for eligible work-related travel expenses. This is an average of 1286 per work trip. Common travel expenses include among others. The average daily cost of business travel in the US is 325 per day. Car and travel expenses 2021 Work-related car expenses and work-related travel expenses are expenses you incur in the course of performing your job as an employee.

Source: pinterest.com

Source: pinterest.com

Government agencies in Nevada are required to reimburse their employees for eligible work-related travel expenses. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less. However we consider you to be the owner or lessee of a car and eligible to claim expenses where a family or private arrangement made you the owner or lessee even though you were not. 2021 Travel and Business-Related Expense Policy. See D2 Work-related travel expenses 2021.

Source: myrigadventures.com

Source: myrigadventures.com

Providing travel reimbursing travel accommodation if your employee needs to stay away overnight meals and other subsistence while. See D2 Work-related travel expenses 2021. Government agencies in Nevada are required to reimburse their employees for eligible work-related travel expenses. Business center expenses copy fax printing phone and internet access charges. If you carry tools instruments or other items in your car to and from work you can deduct only the additional.

Source: blog.spendesk.com

Source: blog.spendesk.com

Volunteers and Contractors The State Bar greatly appreciates the service of its many volunteers and is able to reimburse reasonable documented travel expenses incurred for State Bar business pursuant to this policy. Parking and tolls. If you carry tools instruments or other items in your car to and from work you can deduct only the additional. DOMESTIC TRAVEL EXPENSES INCURRED 1 July 2020 to 30 June 2021 Short Term Car Hire. Fyle 2020 Companies spend 1117 billion on business travel every year.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title work related travel expenses 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.